Ava Risk Group Limited (ASX: AVA) (“Ava Risk Group” or “the Company”) is pleased to provide the following update on its Q3 FY2024 trading performance:

- Q3 sales order intake of $6.8 million, resulting in year-to-date (YTD) sales order intake of $26.6 million, up 15% on the prior year.

- Major supply agreement signed with Telstra Group for the supply of products and services from all operating segments – Detect, Access and Illuminate. Execution of this agreement establishes a substantial opportunity in the global telecommunications market.

- Confirmed sales order backlog of $8.3 million; approximately two thirds is expected to convert to revenue in the current financial year, with the remainder to be delivered predominantly in FY2025.

- Successful completion of a $3.0 million institutional placement of new fully paid ordinary shares and a share purchase plan for eligible existing shareholders to raise up to an additional $1.0 million. Participation in the share purchase plan expires on 30 April 2024.

- Second half revenue guidance reaffirmed at $16 million to $20 million (range dependent on project delivery timing).

Ava Group CEO Mal Maginnis commented: “Growth in sales order intake remains strong at 15% on the prior year. Order intake during Q3 in Detect was lower than the previous quarter due to project timing. I remain confident in the quality of the pipeline in the Detect business and we expect to finalise various opportunities in Q4.”

“Execution of the supply agreement with Telstra represents a significant milestone. Following a period of extensive collaboration, the agreement clearly demonstrates the adaptability of our market leading fibre sensing technology to adjacent applications such as telecommunications. Importantly, it also provides an opportunity to supply our Access and Illuminate solutions in the sector.”

“Completion of the institutional placement of $3.0 million in new shares highlights the continued support from existing investors as well as attracting new investors. This strengthens our balance sheet and leaves us well placed to pursue growth and execute on significant major contracts such as UGL and Telstra.”

Q3 FY2024 confirmed sales orders

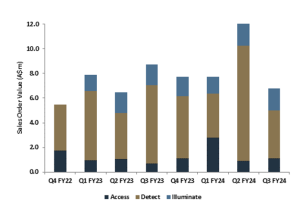

YTD sales order intake of $26.6 million is an increase of 15% on the previous year. All operating segments recorded growth on the previous year. Q3 sales order intake of $6.8 million is lower than the previous quarter due to the timing of some Detect opportunities which are forecast to close within Q4.

- Detect: Q3 sales order intake of $3.9 million resulting in YTD order intake of $16.8 million, an increase of 8% on the previous year. The order intake in the quarter was underpinned by a strong performance in Australia ($2.2 million) and U.K. / Europe ($0.8 million). Performance in the Americas and Middle East was slightly subdued with material increases expected in Q4 as a number of opportunities close within the final quarter.

- Access: Total Q3 order intake of $1.0 million continues to build on the strong first-half, resulting in YTD order intake of $4.8 million, up 73% on the previous year. This includes additional orders from dormakaba for the Cobalt series locks as H1 stocking orders move through its distribution network. This remains a key focus to drive additional orders during Q4 and beyond.

- Illuminate: The Illuminate segment continues its improved trajectory with Q3 sales order intake of $1.8 million resulting in YTD order intake of $5.0 million, up 5% on the previous year. The Company remains confident of further growth in Illuminate in Q4 and beyond based on improved domestic performance in the U.K. and expansion into new geographies in Asia Pacific and the Americas.

Importantly, at the end of Q3 FY2024, Ava Risk Group carried an order backlog of $8.3 million which represents sales orders received that are still to be fulfilled. Of the backlog, $5.3 million relates to anticipated project delivery in Q4 FY2024 with most of the remainder to be delivered in FY2025.

Chart 1 – Sales Order Intake

Supply Agreement with Telstra Group

On 9 February 2024, the Company announced that it had executed a supply agreement with Telstra Group for the supply of products and services from each of its operating segments. The agreement was the culmination of extensive collaboration with Telstra including product trials with Telstra and its customers. It represents a significant milestone and demonstrates the adaptability of Ava Risk Group’s market leading fibre sensing technology to adjacent applications such as telecommunications.

The agreement opens a substantial new opportunity in the telecommunications sector. The product trials demonstrated the superior ability of the Company’s fibre sensing technology to be deployed to Telstra’s existing fibre network to detect events and provide appropriate classification and reporting. It provides a rich source of data to Telstra and effectively turns the existing fibre network into sensors. Engagement with Telstra is ongoing to develop a program of work for delivery in FY2025 and beyond.

Institutional Placement and Shareholder Purchase Plan

During Q3 the Company completed an institutional placement of $3.0 million of new fully paid ordinary shares. The shares were acquired by existing and new shareholders with demand reflecting continued support for the Company’s growth strategy.

The Company also launched a share purchase plan for eligible existing shareholders which is expected to raise up to an additional $1.0 million. Participation in the share purchase plan expires on 30 April 2024.

Proceeds from both the institutional placement and share purchase plan will go towards supporting the execution of recently announced major contract wins, including working capital and product development requirements for large scale Detect programs.

Outlook

Based on the existing order intake and expected sales pipeline conversion, management provides revenue guidance for the second half year in the range of $16 million – $20 million (range dependent on the timing or project delivery).

ENDS

Approved for release by the Board of Directors.

For further information, please contact:

Investor Enquiries

Alexandra Abeyratne

Morrow Sodali

aabeyratne@morrowsodali.com

+61 438 380 057

About Ava Risk Group

Ava Risk Group is a global leader in providing technologies and services to protect critical and high value assets and infrastructure. It operates three business segments – Detect, Access and Illuminate. The Detect segment manufactures and markets ‘smart’ fibre optic sensing systems for security and condition monitoring for a range of applications including perimeters, pipelines, conveyors, power cables and data networks. Access is a specialist in the development, manufacture and supply of high security biometric readers, security access control and electronic locking products. Illumination specialises in the development and manufacture of illuminators, ANPR cameras and perimeter detectors. Ava Risk Group products and services are trusted by some of the most security conscious commercial, industrial, military and government clients in the world. www.avariskgroup.com