Ava Risk Group Limited (ASX: AVA) (“Ava” or “the Company”) announces results for the six months ended 31 December 2024.

Highlights

- Group revenue of 17.0 million, up 20% on the previous corresponding period (PCP)

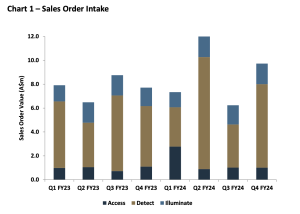

- Strong sales order intake of $16.3 million, driven primarily by the Detect segment

- Expansion in strategically important industry verticals and key projects across sovereign border protection,

- airport perimeter detection, and transportation

- Group EBITDA of $1.7 million, $2.6 million higher than PCP

- Sales order backlog of $7.6 million, including $2.3 million in contacted annual recurring revenue

- Cash balance of $4.7 million at 31 December 2024.

Review Investor Presentation here.

Review Appendix 4B and Interim Consolidated Financial Report here.

Ava has invested significantly in its commercial capability and technology in order to grow revenue and increase market share. The results for H1 FY2025 indicate that these investments are providing a platform for continued improved performance.

Ava CEO Mal Maginnis said: “We are pleased with the Group’s progress during H1, with a strong sales pipeline across key industry verticals. Our industry leading fibre sensing technology continues to underpin strong sales momentum in the Detect segment, with some notable contracts including the protection of a critical European border, as well as airport perimeter detection orders in Dubai and North America. We also saw an increase in recurring service contracts, a key marker of future performance, which was driven by increased system deployments.

“We are also pleased to have achieved a positive EBITDA result, a reflection of the investments made into the technology and commercial capabilities of the business. We see significant growth catalysts across the segments and are focused on improving our performance further through our sales order intake, our sales backlog and by increasing recurring revenue. We are also focused on maintaining high gross margins and expect to benefit from strong operating leverage as we scale.”

Performance Overview

The Group’s revenue for the half was $17.0 million, up 20% on PCP. Strong sales order intake of $16.3 million was driven primarily by the Detect segment, with a confirmed sales order backlog of $7.6 million, including $2.4 million in contracted annual recurring revenue, also up 20%. The order backlog consists of equipment orders and multi-year service contracts.

The Company is focused on developing its sales opportunity pipeline in key industry verticals and growing its recurring revenue base. During H1 FY2025 repeat orders for Aura Ai-X, the Company’s market leading fibre sensing technology, were fulfilled for protection of a critical European border, including the replacement of some competitor technology. Airport perimeter detection is an emerging industry vertical and sales orders were fulfilled for the deployment of systems at Dubai International Airport and a major North American airport.

Consolidated gross margin grew to 64%, up 3% on the prior year, driven by an increase in higher margin Detect

revenue. Operating costs stabilised following completion of the restructure during FY2024 and were $0.3 million

lower than the prior year. The resulting EBITDA of $1.7 million was $2.6 million higher than PCP (1H24: EBITDA loss of $0.9 million). The Company had a cash balance of $4.7 million at 31 December 2024.

![]() In the Detect segment, revenue of $12.1 million represented growth of 57% on PCP. The improved performance

In the Detect segment, revenue of $12.1 million represented growth of 57% on PCP. The improved performance

was driven by completion of a number of key projects including the supply of equipment to a mine site in Chile and

further deployment of additional systems for an Eastern European border.

Revenue in the Access segment of $2.0 million was $1.2 million lower than PCP which included initial stocking

orders of the Cobalt series locks for dormakaba in the U.S. Leveraging dormakaba’s global distribution network

remains critical to near term growth in the Access segment.

In the Illuminate segment, the new “LoRa” product is enabling the seamless integration of a number of the

Company’s devices in a common solution. The complementary nature of Illuminate products with Detect is

demonstrated by the development work being undertaken with UGL to provide solutions on the Sydney Metro

project and by some Illuminate product trials undertaken with Telstra.

Outlook

Based on expected sales pipeline conversion and the existing sales order backlog, management provides revenue

guidance for the full year FY2025 in the range of $37.0 million – $41.7 million.

Approved for release by the Board of Directors.

For further information, please contact:

Investor Enquiries

Alexandra Abeyratne

Sodali & Co

alexandra.abeyratne@sodali.com

+61 438 380 057

About Ava Risk Group

Ava Risk Group is a global leader in providing technologies and services to protect critical and high value assets and

infrastructure. It operates three business segments – Detect, Access and Illumination. The Detect segment manufactures

and markets ‘smart’ fibre optic sensing systems for security and condition monitoring for a range of applications

including perimeters, pipelines, conveyors, power cables and data networks. Access is a specialist in the development,

manufacture and supply of high security biometric readers, security access control and electronic locking products.

Illumination specialises in the development and manufacture of illuminators, ANPR cameras and perimeter detectors.

Ava Risk Group products and services are trusted by some of the most security conscious commercial, industrial, military and government clients in the world. www.avariskgroup.com

You must be logged in to post a comment.