Ava Risk Group Limited (ASX: AVA) (“Ava Risk Group” or “the Company”) is pleased to provide the following update

on its Q4 FY2022 Trading performance:

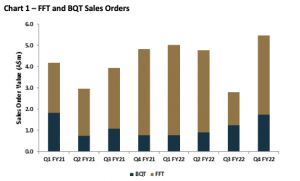

- Strong uplift in sales order intake with confirmed orders of $5.5m during Q4 FY2022. This represents the strongest quarterly sales performance since the onset of COVID-19 related business disruptions.

- Full year confirmed sales order intake of $18.0m for FFT and BQT, 13% increase on FY2021 confirmed orders.

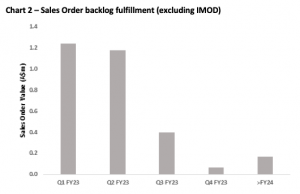

- Confirmed sales order backlog of $3.2m of which $1.2m is expected to be fulfilled in Q1 FY2023.

- FY2022 revenue guidance of $29.8m to $30.2m, slightly below previous guidance of $31.3m to $33.3m

reflecting the timing delay of certain expected orders, including Aura IQ. - Secured the first commercial order for Aura IQ in July; additional sales orders anticipated in H1 FY2023.

- Strong financial position with consolidated net cash of $15.2m and no debt at 30 June 2022 after distribution

of $39.2m to shareholders during Q4 via special dividend and capital return.

Commenting on the trading performance, Ava Group CEO, Rob Broomfield, said: “As anticipated, sales momentum grew during Q4 and we recorded our strongest quarterly performance since before the pandemic. While the quarter was exceptionally strong, a number of additional sales orders which we anticipated in Q4 were delayed to Q1 FY2023, which has impacted our FY2022 revenue outcome. We received our initial Aura IQ order in early July, and we expect the other delayed orders, including additional Aura IQ contracts, to be finalised over the remainder of the 2022 calendar year.”

Q4 FY2022 confirmed sales orders

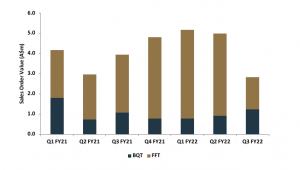

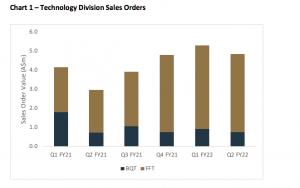

There was a significant uplift in sales order intake during the quarter with confirmed sales orders of $5.5 million, resulting in full year sales orders of $18.0 million for FY2022. Orders received in Q4 represent the highest order intake since the COVID-19 disruption began and builds on Ava’s recent market momentum. The full year order intake for FY2022 represents growth of 13% on FY2021, driven by increased orders in FFT and strong H2 performance in BQT.

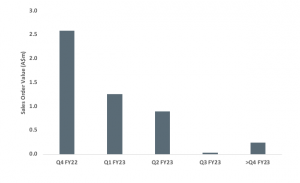

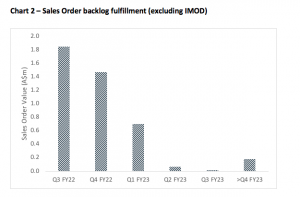

The sales pipeline remains very strong, and a number of opportunities that were expected to close in Q4 FY2022 have since closed or are anticipated to close in H1 FY2023. There is continued focus on providing long term support contracts to the FFT installation base – at the end of June 52 systems had been signed to these agreements. The Company carries a sales order backlog of $3.2 million, representing sales orders that have been received but have not yet been fulfilled. It is anticipated that $1.2 million of the backlog will be fulfilled in Q1 FY2023. The backlog does not include any additional sales orders under the Indian Ministry of Defence contract.

Ava’s first order for Aura IQ from a leading global conveyor manufacturer was received in early July 2022.

Update on Aura IQ

The Company achieved a significant strategic milestone in early July when it received the first commercial order for the FFT Aura IQ solution. The order, for the supply and installation of Aura IQ with a leading global manufacturer of conveyor systems, had been expected during Q4 FY2022 but was delayed pending internal procurement approvals with the end user. Receipt of the order was the culmination of a series of successful proof of value trials on operating mine sites.

Integration of Aura IQ with a fibre-optic fire detection system was completed at the request of a major global mining company during Q3 FY2022 and was successfully tested during Q4. Additional sales orders with the mining company are progressing through purchasing approvals and are expected to be finalised over the remainder of the 2022 calendar year.

FY2022 Financial Performance

Management provides full year revenue guidance for FY2022 in the range of $29.8 million to $30.2 million. Full year revenue from FFT and BQT is expected to be in the range of $18.7 million to $19.1 million.

Full year revenue guidance is slightly lower than the previously advised range of $31.3 million to $33.3 million due to a number of anticipated sales orders being delayed until Q1 FY2023.

Ava Risk Group will release its financial results for the year ending 30 June 2022 on Friday 26 August 2022. Details on an investor webcast will be provided to the market in due course.

ENDS

Approved for release by the Board of Directors.

For further information, please contact:

Investor & Media Enquiries

Alexandra Abeyratne

Citadel-MAGNUS

aabeyratne@citadelmagnus.com

+61 438 380 057

About Ava Risk Group

Ava Risk Group is a global leader in providing technologies and services to protect critical and high value assets and infrastructure. It operates two business segments – Future Fibre Technology (FFT) and BQT Solutions (BQT). FFT manufactures and markets ‘smart’ fibre optic sensing systems for security and condition monitoring for a range of applications including perimeters, pipelines, conveyors, power cables and data networks. BQT is a specialist in the development, manufacture and supply of high security biometric readers, security access control and electronic locking products. Ava Risk Group products and services are trusted by some of the most security conscious commercial, industrial, military and government clients in the world. www.avariskgroup.com