Ava Risk Group Limited (ASX: AVA) (“Ava Risk Group” or “the Company”) is pleased to provide the following update on its Q3 FY2022 Trading performance:

- Q3 FY2022 confirmed sales orders of $2.8m, resulting in year to date (“YTD”) sales orders of $13.0m (up 17% on the prior year, excluding prior year orders from the Indian Ministry of Defence (“IMoD”) contract)

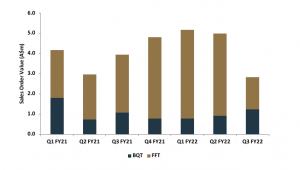

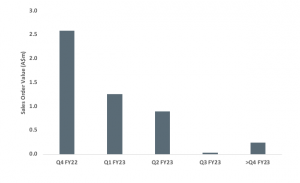

- Confirmed sales order backlog of $5.0m of which $2.6m is expected to be fulfilled during Q4 FY2022

- Aura IQ successfully integrated with fire detection solution and purchasing approvals within the global mining company anticipated to be completed within Q4.

- BQT sales orders boosted by post lockdown recovery and anticipated acceleration of new dormakaba Global Framework Agreement

- Approval granted at Extraordinary General Meeting for return of capital of approximately $7.566m or $0.03114 per share

- Management reaffirms FY2022 revenue guidance of $31.3m to $33.3m due to a strong pipeline and expected performance in Q4.

Ava Group CEO Rob Broomfield commented: “Though Q3 was slightly quieter in terms of sales order intake, we remain confident in the quality of our sales opportunity pipeline and expected performance in Q4 and into FY2023. In the near term, we look forward to receiving our first commercial order for Aura IQ following the successful integration of our conveyor monitoring solution with existing fire detection capability. We also continue to manage supply chain availability, particularly for components sourced from China.

During March, we exhibited at the ISC West Trade Show in the United States, one of the largest security trade shows in the world. After the trade show had been impacted by Covid-19 in the previous two years, this show reaffirmed our belief of significant growth in the sector. It was very successful in terms of reconnecting in person with our customer base for both the FFT and BQT segments as well as showcasing our enhanced solutions to prospective customers. For BQT in particular, the show provided an opportunity to meet with dormakaba’s global leadership team to accelerate implementation of the Global Framework Agreement signed in December 2021”.

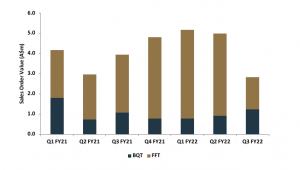

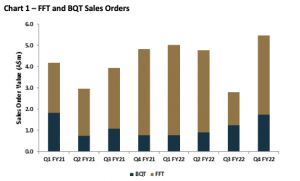

Q3 FY2022 confirmed sales orders

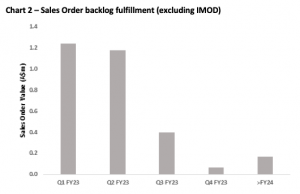

During Q3 FY2022 the Technology Division received confirmed sales orders of $2.8 million, resulting in YTD sales orders of $13.0 million. YTD sales order intake reflects growth of 17% on the prior year (excluding prior year orders from the IMoD contract), driven primarily by increased sales orders from FFT. Sales orders received during Q3 were not as strong as the previous two quarters attributable in part to a seasonal slowdown in the US security market in January and slight delays in the timing of some expected orders. Q4 has started strongly and the Company is confident that order intake in Q4 will align with the run rate during the first two quarters.

During Q3 FY2022 we increased the number of FFT systems signed to maintenance contracts. As at the end of Q3, a total of 49 systems have been signed to maintenance agreements using the existing sales and support team.

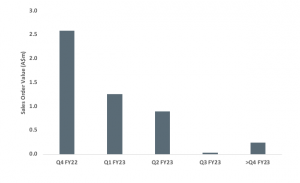

The Company carries an order backlog of $5.0 million which represents sales orders received that will be fulfilled in the future. It is anticipated that $2.6 million of the backlog will be fulfilled during Q4 FY2022. The backlog does not include any additional sales orders under the IMoD contract, or sales orders expected to be received and fulfilled in Q4. As previously advised, the Company is not expecting any contribution from the IMoD contract in FY2022.

Chart 1 – Technology Division Sales Orders

Chart 2 – Sales Order backlog fulfillment (excluding IMoD)

Update on Aura IQ

As advised in February 2022, FFT has been requested by a global mining company to integrate its advanced conveyor condition monitoring solution with a fibre optic-based fire detection solution. Ava is pleased to advise that the qualification of Aura IQ with the fire detection fibre optic cable was successfully completed by the end of Q3. Based on the successful integration, purchasing approvals within the global mining company have recommenced and are expected to be completed within Q4.

Testing of the integrated condition monitoring and fire detection solution is scheduled to commence with a second major mining company in May. The outcome of the testing will result in qualification of the solution on underground conveyors. The integrated condition monitoring and fire detection capability continues to generate significant commercial opportunities for global partnerships to support the mining industry.

Update on Global Framework Agreement with dormakaba

As advised in December 2021, the Company signed a Global Framework Agreement with dormakaba for the supply of BQT products and services. During Q3, BQT received an initial stock order to provide inventory for the launch of BQT products across dormakaba’s global network. Planning is advanced with dormakaba for the global launch including appropriate training and supporting documentation for the product range. The initial stock order is expected to be fulfilled in Q4, with subsequent orders to generate incremental growth into FY2023.

Return of Capital

Ava Risk Group Limited held an Extraordinary General Meeting (“EGM”) on 22 April 2022 where shareholder approval was sought for a capital return of $7.567 million or $0.03114 per fully paid ordinary share. Shareholders approved the resolution, and the Company will return capital to its shareholders based on a:

- record date of 28 April 2022; and a

- payment date of 5 May 2022.

The Company also paid a special dividend of $0.13 per eligible share on 10 March 2022 (approximately $31.585 million).

Outlook for FY2022

Management confirms its full year revenue guidance for FY2022 in the range of $31.3 million to $33.3 million. Full year revenue from the Technology Division is expected to be in the range of $20.2 million to $22.2 million. It is noted that the attainment of forecast revenue is contingent on the fulfilment of orders expected to be received during Q4 and that supply chains remain unimpeded. To date the Company has successfully managed supplier related issues though it is recognised that the environment continually changes particularly in light of recent lockdowns in some provinces in China.

ENDS

Approved for release by the Board of Directors.

For further information, please contact:

| Investor Enquiries

Vanessa Beresford |

Media Enquiries

Alexandra Abeyratne |

| Citadel-MAGNUS |

Citadel-MAGNUS |

| vberesford@citadelmagnus.com |

aabeyratne@citadelmagnus.com |

| +61 451 422 892 |

+61 438 380 057 |

About Ava Risk Group

Ava Risk Group is a global leader in providing technologies and services to protect critical and high value assets and infrastructure. It operates two business segments – Future Fibre Technology (FFT) and BQT Solutions (BQT). FFT manufactures and markets ‘smart’ fibre optic sensing systems for security and condition monitoring for a range of applications including perimeters, pipelines, conveyors, power cables and data networks. BQT is a specialist in the development, manufacture and supply of high security biometric readers, security access control and electronic locking products. Ava Risk Group products and services are trusted by some of the most security conscious commercial, industrial, military and government clients in the world. www.avariskgroup.com

You must be logged in to post a comment.